Your Council Tax 2025

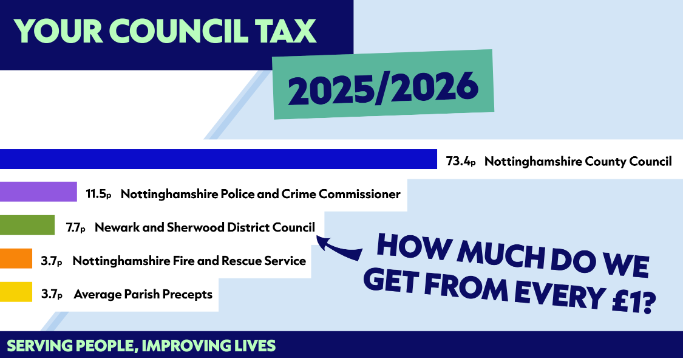

7.7p in every £1 you pay in Council Tax comes to us at the District Council. The rest of the money you pay goes to your Parish or Town Council, Nottinghamshire County Council, Nottinghamshire Police and Crime Commissioner and Nottinghamshire Fire and Rescue.

Following an accepted amendment at Full Council on 6 March 2025, Council Tax was set at 1.94%, reduced from the proposed initial increase of 2.99%. The infographic above reflects that change.

Where does my Council Tax go

You can click on the links below to see what your Council Tax band is. If you have any difficulties in paying your Council Tax, please contact us.

Find out more about Council Tax bands.

Find out more about your Parish or Town council.

41% of homes in Newark and Sherwood fall into Council Tax Band A. This is the largest proportion of District Council homes within one band. Based on Band A homes the table below shows how much of your Council Tax goes to each organisation.

|

Organisation |

How much in every £ in 2024/2025 |

Council Tax increase (from 1st April 2025) |

How much in every £ in 2025/2026 |

2025/26 Band A charge per organisation |

|

Nottinghamshire County Council |

73.3p |

4.84% |

73.4p |

£1,263.03 |

|

Nottinghamshire Police and Crime Commissioner |

11.4p |

4.94% |

11.5p |

£197.40 |

|

Nottinghamshire Fire Service |

3.7p |

5.42% |

3.7p |

£64.81 |

|

Local Town and Parish Council |

3.7p (on average)* |

4.94% (on average)* |

3.7p (on average)* |

£63.84 (on average)* |

|

Newark and Sherwood District Council |

7.9p |

1.94% |

7.7p |

£132.40 |

*Parish precepts change depending on the area you live. You can view your individual Town and Parish Council costs here: Parish precepts 2025/26 (PDF File, 237kb)

Who is responsible for paying Council Tax?

Council Tax payment is the responsibility of owner-occupiers or, if rented, council tenants, private tenants and tenants of housing associations. You can pay your Council Tax bill in different ways.

Council Tax is also payable on unoccupied furnished and unfurnished houses in certain circumstances. Find out more about reductions and exemptions.

How do we spend our Council Tax money?

Newark and Sherwood District Council run a number of services for you.

You can find more detail about how Newark and Sherwood District council spends your money on the council strategies and policies and council budgets page. To see what your Council Tax money is spent on in relation to the climate emergency visit our climate emergency page.

Statutory Council Tax information

To see a breakdown of your Council Tax charges please click here: Council Tax charges revised 2025/26 (PDF File, 239kb)

To see a summary of where your Council Tax will be spent please click here: Newark and Sherwood District Council spending 2025/26 [12kb]

More information

If you have a query regarding the detail provided, any aspect of your bill or would like to receive a hard copy of the details provided here, contact us.

You can also contact the different services funded by your council tax using the details below.

Nottinghamshire County Council

Tel 0300 500 80 80

Email enquiries@nottinghamshire.gov.uk

Visit their website

View council tax - where your money goes

Nottinghamshire Police and Crime Commissioner

Tel 0115 967 0999

Email nopcc@nottinghamshire.pnn.police.uk

Visit their website

Policing Council Tax 2024/25 (PDF File, 4,466kb)

Nottinghamshire Fire and Rescue Service

Tel 0115 967 0880

Email enquiries@notts-fire.gov.uk

Visit their website

View their council tax information